“The Church of England parishes collectively receive over £80 million in Gift Aid tax rebates

Church of England Parish Resources

each year… sufficient to pay 1,600 stipendiary clergy.”

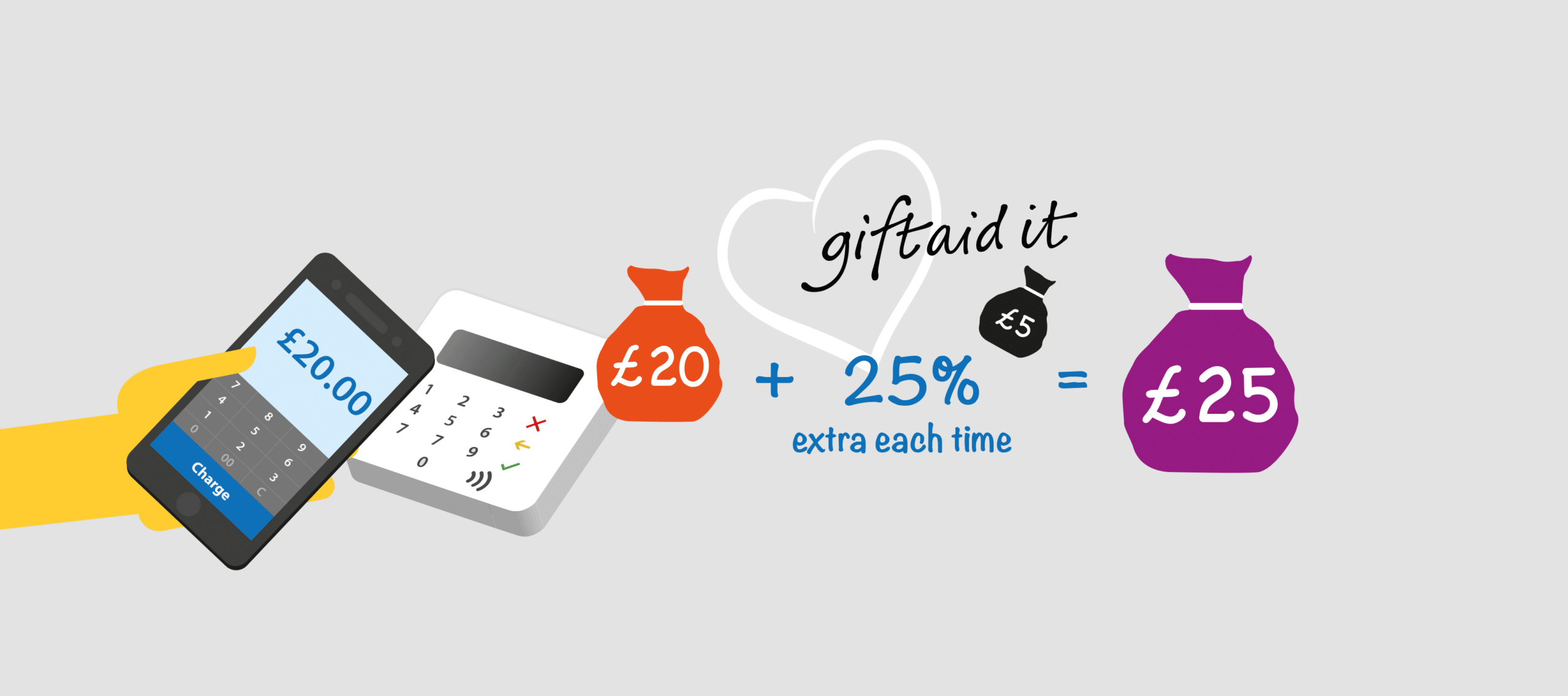

We encourage donors who are taxpayers to complete a Gift Aid form so that churches can recover the basic-rate tax aid on donations. Some online and contactless giving platforms can collect and report Gift Aid declarations for you, making your claim much simpler. The Parish Giving Scheme will automatically remit the Gift Aid on donations to your church monthly – it is the easiest way to maximise your Gift Aid claim.

Gift Aid Small Donations Scheme (GASDS)

Charities can also claim a Gift Aid-like repayment on up to £8,000 of small cash donations each tax year. The maximum amount which be claimed is £2,000. Eligible donations must be £30 or less, given via contactless or cash.

To be eligible for GASDS, you must be able to supply evidence of:

- small donations being deposited at a bank or post office branch in the UK

- when donations were collected and how (cash or contactless)

- where donations were given – you must be able to supply evidence that collections were taken at gatherings of at least 10 people.

For regular givers who donate cash to your parish, make sure you have an envelope register as evidence for GASDS. This should identify regular planned giving in envelopes not covered by a Gift Aid declaration. These can also be included in the scheme provided the donation given in a particular week is in cash and is £30 or less.

Parish Resources has detailed advice on how best to apply for GASDS, depending on whether your parish is single- or multi-church.

Recent Changes to Highlight

Due to the COVID-19 pandemic, HMRC has made the following alterations to Gift Aid guidance.

GASDS Update for Irregular Gifts

At the HMRC Charity Tax Forum meeting in January 2021, Charity Tax Group asked whether the concession regarding GASDS (allowing GASDS in cases where regular donors, particularly churchgoers, to save up the cash they would have put in the collection each week and give it to the Treasurer in one large cash amount) was restricted to COVID times.

In minutes of the meeting, HMRC has confirmed that this was not unique to the pandemic and it was not a concession; provided the treasurer was satisfied that cash received was multiple small donations which happened to be in one envelope, then they could claim GASDS subject to the normal rules. This could be particularly helpful when regular donors are on holiday or required to miss events/church services for an extended period due to lockdowns or illness. You can read more on the Charity Tax Group website.

New HMRC Guidance on Waived Refunds and Loan Repayments

In May 2021, HMRC issued guidance confirming that Gift Aid can now be claimed on waived refunds and loan repayments, where previously this was not possible.

Having created a temporary concession in April 2020 due to the cancellation of many charity events, HMRC has now made this change permanent.

Find out more about this updated guidance on the Charity Tax Group website.

Gift Aid Practice

Her Majesty’s Revenue and Customs (HMRC) requires churches to have an audit trail of all donations made.

In 2016, the requirements for declarations changed. The main change is to make clear that it is the donor’s responsibility to pay any difference between the amount claimed in Gift Aid for all charities to which they have donated in a tax year and the amount paid in income tax or capital gains tax. Model Gift Aid declarations, which you can personalise for your church, are available for single donations and multiple donations.

You can collect declarations via telephone and e-mail too. For advice on best practice see this guide.

There are step by step guides to claiming Gift Aid, from basic principles to aggregate claims and other questions on Parish Resources.

For regular givers who donate cash to your parish, make sure you have an envelope register so that you can apply to GASDS (valid for gifts of up to £30).

We put together some of our Top tips for claiming Gift Aid, which you can read in a recent blog post.